David J. Danto

Principal Consultant,

Collaboration/ AV / Multimedia / Video / UC

Dimension Data

Director of Emerging

Technology

Interactive

Multimedia & Collaborative Communications Alliance

eMail:

David.Danto@DimensionData.com ![]() Follow Video &

Technology Industry News: @NJDavidD

Follow Video &

Technology Industry News: @NJDavidD

(Read David’s Bio) (See

David’s CV) (Read David’s Other Blogs & Articles)

Price Gouging

In 2012 my family,

along with much of the US northeast lived through Hurricane Sandy. We

were personally very lucky, with only slight damage to our roof. Many others are still proverbially

underwater, still trying to rebuild their homes and their lives. During that natural disaster it was somewhat

difficult to buy gas for our car, as well as buy the groceries and supplies we

needed. This was due to many factors,

such as the high demand for those products, the difficulty getting them

delivered to the stores, and the many needy people desperate for supplies. Still, during the most difficult times – when

supply was low and demand was high – the stores didn’t dare change their

prices. It would clearly have been

unconscionable for merchants to raise their prices just because of high

demand. The price of a product and/or

service was set by general market forces and didn’t vary simply because of how

much was left.

In 2012 my family,

along with much of the US northeast lived through Hurricane Sandy. We

were personally very lucky, with only slight damage to our roof. Many others are still proverbially

underwater, still trying to rebuild their homes and their lives. During that natural disaster it was somewhat

difficult to buy gas for our car, as well as buy the groceries and supplies we

needed. This was due to many factors,

such as the high demand for those products, the difficulty getting them

delivered to the stores, and the many needy people desperate for supplies. Still, during the most difficult times – when

supply was low and demand was high – the stores didn’t dare change their

prices. It would clearly have been

unconscionable for merchants to raise their prices just because of high

demand. The price of a product and/or

service was set by general market forces and didn’t vary simply because of how

much was left.

We would never tolerate the last

container of milk in a store costing five-hundred percent more than the first

container. We would never tolerate the

last two seats in a movie theater costing more than all of the others. Then, for gosh sakes, why do we tolerate it

when the airlines and hotels change their prices based upon demand?

I and many others have lamented the legacy

pricing structure for many years. “If Airlines

Sold Paint” is one of the most famous stories to lampoon this practice,

followed-up by my recent “If Airlines Were

Restaurants” which delved into the lack of viable competition and

borderline antitrust airline practices we live with in the current

environment. Today’s reality however is

that the gouging we’d find unconscionable in just about every other industry is

totally out of control in the travel industry.

This week I was presented with a stark

reminder of just how bad the situation is when I went to purchase airfare for a

conference. CES (formerly known as the Consumer Electronics

Show) is the largest industry conference in the US. (For the last couple of years they’ve capped

attendees at 150,000 – and that number doesn’t include exhibitors and associated

personnel.) Once a year, right after the

New Year holiday, technologists, specialists and buyers head to Las Vegas to

attend this glimpse into the future of technology. I’ve been honored to have been named as a CES

Innovations Judge a few times, including last year.

Roundtrip, nonstop airfares from Newark

to Las Vegas – which usually start around $300 and peak around $600 are coming

in between $900 - $1,200 for a coach ticket to attend this conference (arriving

before the first press conference and leaving on the last Sunday.) That’s about a grand for a coach seat on a

flight that is currently less than 50% booked today. This isn’t even a situation where there is

limited supply. It’s a case where the

airlines know that people have to go on those days so they’ll charge whatever

they feel like. If that isn’t the very

definition of price gouging then I don’t know what is.

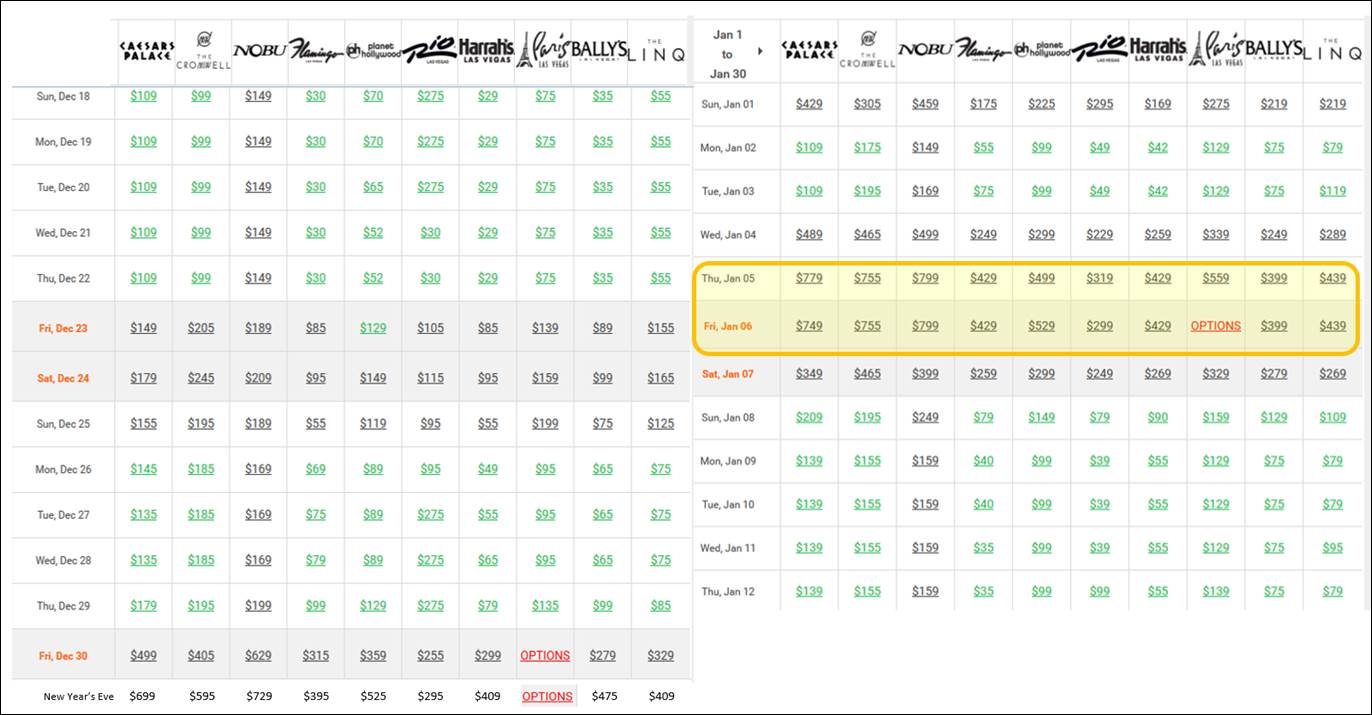

The hotels aren’t really any better in

this case. Take a look at the rate

calendar for Caesars properties below:

The Thursday and Friday of CES is

actually priced more expensively than New Year’s Eve – the busiest holiday of

the year in Las Vegas. (I’m only showing

Caesars properties because their rate calendar was easy to copy from here

– the MGM Resorts and other hotels are priced just as obscenely on those

days.) Just contemplate that level of

gouging for a moment. Caesars Palace is

charging $779 on a Thursday for a room they feel is only worth $139 on the

following Thursday – that’s a 560% increase.

A month of Thursday prices for Paris Las Vegas run $75, $135, $559, and

$139. While I could understand some

premium for the last few rooms in a nearly sold-out property, how can anyone

justify these spreads – especially if “because they can get it” is the only

justification. Why is that any different

than charging $10 for a quart of milk or $12 for a gallon of gas?

Clearly more regulation needs to return

to these industries – especially the airline industry, where the service

providers are operating in airspace and at airports that the public owns. Just as regulatory officials looked for and

shut-down gas stations that overcharged during periods of high demand, our

government watchdogs should be identifying and putting a stop to gouging in

these industries as well.

This article was written by David Danto and

contains solely his own, personal opinions.

All image and links provided above as reference under

prevailing fair use statutes.