David J. Danto

Business travel

thoughts in my own, personal opinion

eMail: ddanto@IMCCA.org Follow Industry News: @NJDavidD on all ![]()

![]()

![]()

![]()

The New Cost Of

Plastic – September 2023

Using credit cards to collect miles/points/cashback used to be a smart strategy. Lately however, I’m beginning to second guess

that. Affinity credit card rewards looks

like they will be the next big thing from our past that will be drastically

changing. More and more businesses are

starting to charge extra for use of credit cards.

Using credit cards to collect miles/points/cashback used to be a smart strategy. Lately however, I’m beginning to second guess

that. Affinity credit card rewards looks

like they will be the next big thing from our past that will be drastically

changing. More and more businesses are

starting to charge extra for use of credit cards.

In the past, some retail stores would not allow the

use of some brands of cards, and also require minimum purchases to use  any of them.

Gas stations were next, with many charging different prices for cash or

credit. That seemed to be the norm for a

very long time, but lately the ‘I’m not paying a fee for your convenience’

attitude has crept into many more businesses.

any of them.

Gas stations were next, with many charging different prices for cash or

credit. That seemed to be the norm for a

very long time, but lately the ‘I’m not paying a fee for your convenience’

attitude has crept into many more businesses.

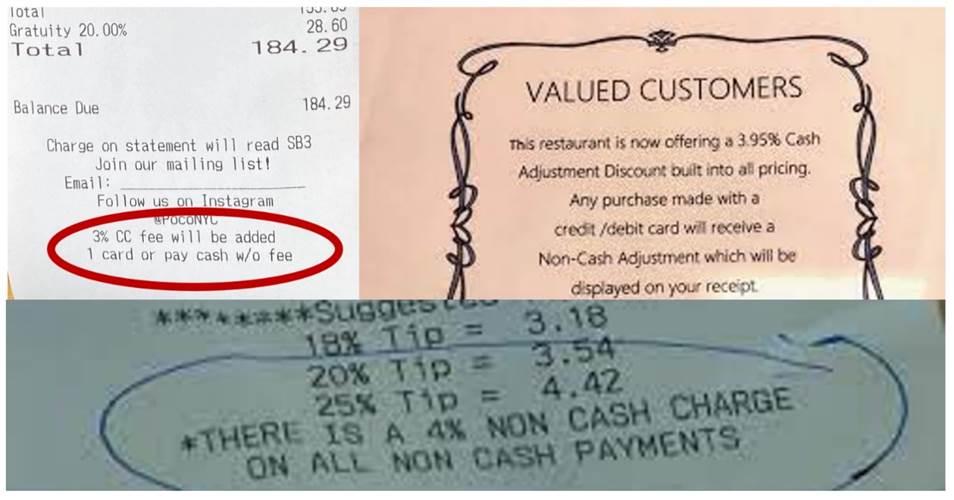

During the pandemic, many of the restaurants that were

able to stay open started charging extra percent add-on fees. At first it was for the cost of just staying

open and sanitary – and I was happy to pay for that. Then, as supply chain issues crept-up that

was the reason for the extra cost on every bill. Now it is difficult to find a nice restaurant

that isn’t also charging extra for the privilege of using a credit card. They got so used to charging everyone a bit

more that the credit card processing fee (the card companies charge them) was

the easiest, next thing to pass along to customers.

Now the wireless phone companies are getting into the

act. AT&T,

Verizon and T-Mobile have all announced that automatic payments set to credit

cards will now be charged a fee. Of

course, they don’t say it that way. Just

like most of the restaurants above they describe the direct payment from a bank

account as a “discount” that they are extending, and they will now ‘phase-out

that discount’ for credit card payments.

What does all this mean for you and I, the frequent

travelers of the world? Well, the best

credit card I have for dining and entertainment is the Capital One Savor, which

offers four percent cash back on those transactions. That means, at restaurants charging about

four percent to use the card it’s a wash.

At other establishments and with other credit cards, I’m likely paying

extra for the miles or points that I’m getting – in essence buying them

directly at hugely inflated prices compared to what the bank or issuing company

is paying to get and offer them.

I don’t think I’m going to stop paying with credit

cards, as the convenience of not carrying cash everywhere is worth it. I will start paying by check at companies

that take those and charge a premium for using cards (like our cat’s

veterinarian that just took a grand to tell me our cat was ‘fine.’) And I will allow the aforementioned mobile

phone / cable companies to take automatic payments from my bank account.

It's important to note, however, that I’ve set-up a

separate bank account for direct withdrawals.

I’m not using my regular checking account. Not a lot of people realize that giving a

third party the authority to add to (direct deposit) or withdraw (direct bill)

from an account technically allows them to do so whenever they want. That’s too much access for me to feel

comfortable allowing on my primary banking/checking account.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Also, p

Honestly, I don’t know how many people even care that

they are being gouged with these fees.

Airlines and hotel chains have had ‘miles/points sales’ for as

long as I can remember, and there are always apparently some suckers willing to

directly pay exorbitant fees for these constantly devalued items. I still don’t understand why (other than to

top-up for an award) anyone would pay real money for what is essentially fake

money – currency that the firm that controls it devalues at their whim. They often don’t even have mile-price charts

anymore, they just giggle and charge whatever they want for each inquiry. “Get fifty thousand miles for signing up”

for their card, but – oops – they just raised the price of the flight you want

to eighty thousand miles….

This article was written by David Danto and contains solely his own, personal

opinions.

All image and links provided above as reference under

prevailing fair use statutes.

Copyright 2023 David Danto

++++++++

As always, feel free to write and comment, question or

disagree. Hearing from the traveling

community is always a highlight for me.

Thanks!