David J.

Danto

Business travel

thoughts in my own, personal opinion

eMail: ddanto@IMCCA.org ![]() Follow Industry News: @NJDavidD

Follow Industry News: @NJDavidD

Misplaced Priorities – August 2022

Close your eyes and imagine you are the parent of two small children. One

of them studied for weeks and just got a 100 on a school test. The other one only received a grade of 80,

but they never studied, found a way to cheat without getting caught, and finished

the test quickly enough to do all their homework in school before coming

home. Which behavior should you

encourage? Should it be the child that

did the best work, or the child that did work that was “good enough” but was

able to minimize his or her work and maximize his or her productivity? I would hope this is an obvious choice – to encourage

the best possible work – but in our society today we are very frequently not

encouraging that set of values. Instead,

we are letting investors and shareholders elevate actions that extract value,

not those that create it. In my opinion,

these misplaced and unfair priorities are killing us.

Close your eyes and imagine you are the parent of two small children. One

of them studied for weeks and just got a 100 on a school test. The other one only received a grade of 80,

but they never studied, found a way to cheat without getting caught, and finished

the test quickly enough to do all their homework in school before coming

home. Which behavior should you

encourage? Should it be the child that

did the best work, or the child that did work that was “good enough” but was

able to minimize his or her work and maximize his or her productivity? I would hope this is an obvious choice – to encourage

the best possible work – but in our society today we are very frequently not

encouraging that set of values. Instead,

we are letting investors and shareholders elevate actions that extract value,

not those that create it. In my opinion,

these misplaced and unfair priorities are killing us.

Historically, the function of a stock market was to

raise funds that firms could use to invest in creating or improving products

and/or services. If the firm does well then

those buying the stock do well. Somewhere

along the way this dynamic was poisoned.

Firm investors – often institutions and not people – have expectations

that every decision made by that firm has to increase shareholder value,

regardless if it leads toward the excellence or the improvement of the products

and/or services. In fact, if more shareholder

value can be extracted by worsening the product then that is the preferred

course. I can’t possibly overstate how

bad this is.

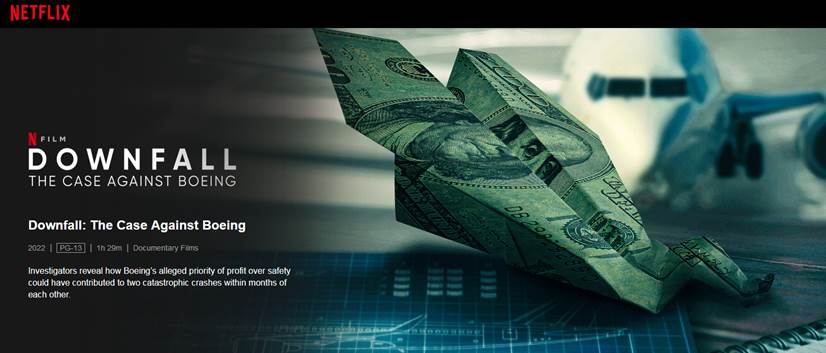

For one example, take a look at Boeing. Earlier

this year I blogged about the Netflix documentary, “Downfall – The Case Against Boeing.” (If

you  haven’t seen it yet you should

ASAP.) It is a clear presentation of how

the culture of creating shareholder value to the detriment of product quality was

directly responsible for hundreds of deaths.

When their firm management changed the company culture from one of

engineering/product excellence to one of increasing stock prices at all costs,

they set themselves up for the inevitable disasters experienced by the 737 Max

and its doomed passengers and crew.

haven’t seen it yet you should

ASAP.) It is a clear presentation of how

the culture of creating shareholder value to the detriment of product quality was

directly responsible for hundreds of deaths.

When their firm management changed the company culture from one of

engineering/product excellence to one of increasing stock prices at all costs,

they set themselves up for the inevitable disasters experienced by the 737 Max

and its doomed passengers and crew.

For another example, look at the recent decision by

the management team of the newly merged Warner Brothers Discovery to kill

the nearly complete film Batgirl. If

the decision holds, the movie, with breakout roles that highlighted inclusion,

and with a fan-gift of Michael Keaton re-appearing as Batman, will never be

seen by the public. Was this decision

because it was a bad movie? Well, if you

believe industry reports, it was actually pretty good for its budget. According to those reports the movie was

shelved because the company management team determined they would make

more money using the project as a tax write-off than as a released movie. Let’s say that again. The company will not release a completed movie

they’ve already paid for because

their bean-counters have determined they will make more money by not releasing

it and instead using it for bookkeeping shenanigans. That of course raises the question about what

industry the firm is in – banking or entertainment?

The prime example of this poison for my typical

readers of course is the commercial airline industry. I doubt that there is a frequent traveler

that wouldn’t choose the air-travel experience of twenty years ago over the one

of today. I struggle thinking of another

industry that has leveraged technological and operational changes to work

against (instead of for) its customers any more than the airlines.

In all of the cases above, the firms have prioritized

shareholder and investor value over the quality of their products, services and/or

performance – and we the public are far worse-off as a result.

Do I have any suggestions to fix this corporate disease? Yes, but they will sadly never happen. I believe CEO and executive pay needs to be

capped at far lower numbers than exist today.

These often brilliant leaders (that without argument need to be well

compensated) need to stop being incentivized to increase the value of their own

holdings in their firms. Tying their

salaries to customer feedback and customer ratings instead of shareholder value

would go a long way toward righting the ship.

In that quixotic and impossible future the quality of the firm’s output

and the compensation of their executives would be aligned. As we will never be able to get there I

believe we are all doomed to suffer the continued lowering of the quality of

what we buy and experience.

So, how long will it be until we give the best grades

to the children that learn to cheat on those school tests above? Finding shortcuts like cheating without

getting caught are, after all, a better measure of what today’s investors will

expect from them after they enter the business world.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

This article was written by David Danto and contains solely his own, personal

opinions.

All image and links provided above as reference under

prevailing fair use statutes.

Copyright 2022 David Danto

++++++++

As always, feel free to write and comment, question or

disagree. Hearing from the traveling

community is always a highlight for me.

Thanks!